Earlier in June, in an effort to gradually return rates to historically normal levels, the Federal Reserve raised interest rates and indicated that two additional increases were on the way. This increase signaled that officials are confident the US economy is strong enough for borrowing costs to rise without slowing economic growth. It also showed they are committed to bringing the inflation rate to its target of 2 percent. However, future increases in interest rates will likely translate into higher borrowing costs for cars, home mortgages and credit cards.

Lower interest rates made housing more affordable over the past few decades, and further increases in mortgage rates might adversely affect home prices. Generally speaking, a rule of thumb is that as mortgage rates increase, existing home sales tend to decline. The lower the mortgage rate, the better the existing home sales.

While there have been fluctuations along the way, mortgage rates have been steadily declining over the past 35+ years. Over this period, payments on mortgage loans also declined which allowed buyers to get more for their money. Continually declining rates also allowed for further reductions in payments through refinancing.

Changing rates can affect affordability as is demonstrated in the chart below. For example, if you were to carry a $500,000 mortgage today, the graph below shows the mortgage payment required for that house based on a range of mortgage rates. As you can see, as the mortgage rate increases so does your payment for that $500,000 loan.

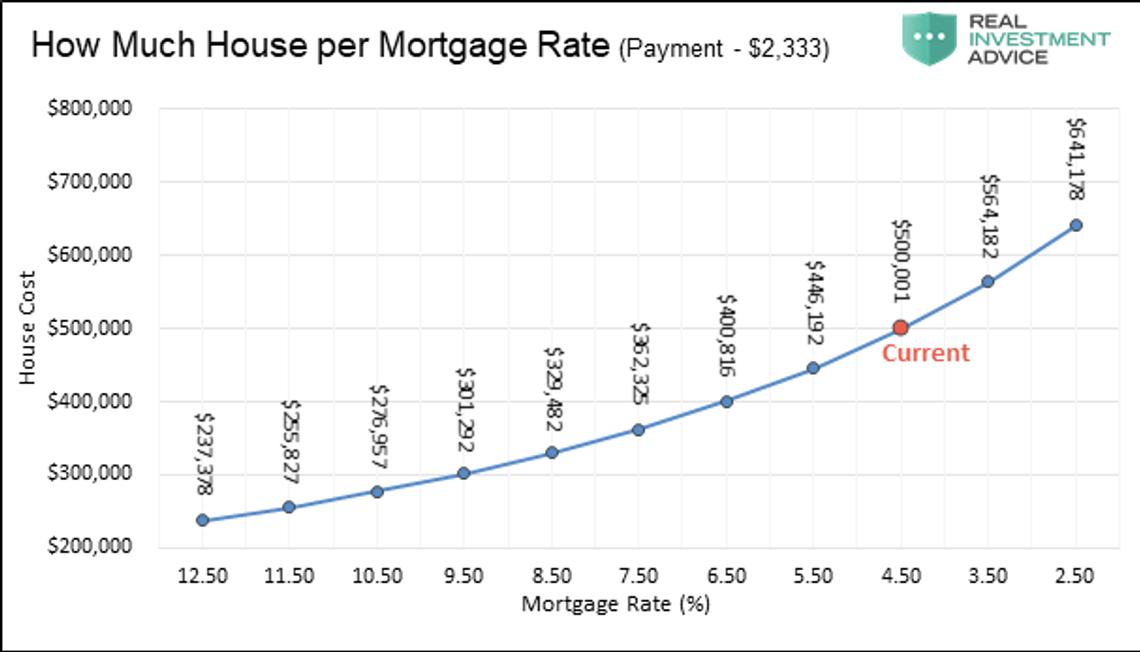

If you were to assume a fixed monthly payment of $2,333 for example, (a $500,000 loan at a 4.5% interest rate), the following graph shows how much you could afford to pay for your house at varying mortgage rates. As you can see by this chart, the higher the mortgage rate the less house you can afford.

As the graphs portray, home buyers will be forced to make higher mortgage payments or seek lower-priced houses if rates keep rising.

I spoke with David Rubenstein of SunQuest Funding to get his take on the recent Fed moves. He said, “With the increase in interest rates, affordability has definitely gone down.” He gave me an example of a $400,000 mortgage at 4.75% costing $2,087/mo. At 5%, that same mortgage would cost $2,147/mo, and at 5.75% it would cost $2,209/mo. It is essentially costing an additional $60/month/quarter point. Over the course of the loan, that can add up to quite a lot of money.

David said, “It is always hard to say when an increase in rates is appropriate — many factors come into play. If the economy continues to grow and inflation remains controlled, the fed will remain confident the economy will be able to absorb another rate increase. But factors such as a trade war or mid-term elections could potentially have an effect on the Fed’s actions.”

David did tell me that while there are many loans being done at 4.75% or below, he is already seeing loans being done at 5% or above depending on an applicant’s credit challenges.

So, if you are on the fence about purchasing a home now or later in the year, now may be the time to commit before the Fed raises interest rates again.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.

By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.